Black Homeownership Initiative:

Building Black Wealth

The Building Black Wealth campaign is CalHFA’s initiative to increase Black homeownership in California. Looking at homeownership through a lens of equity, Black homeownership is far behind. Our campaign provides educational materials, and connections to resources such as free housing counseling and down payment assistance to help close that gap.

When you are ready to buy a house, contact one of our Building Black Wealth partners or a CalHFA Preferred Loan Officer.

Introduction | Video Series | Homeownership Tips | Participating Lenders

Why Black Homeownership Matters

Homeownership has been the most effective way that Americans build wealth, which can be passed down from generation to generation. It also stabilizes communities, provides access to education, and access to employment opportunities.

However, not all Americans have had an equal opportunity to build wealth through homeownership. Historical discrimination through exclusionary housing policies and practices, plus a dwindling supply of housing and a variety of other factors have limited Black families from purchasing homes at the same rate as their White counterparts.

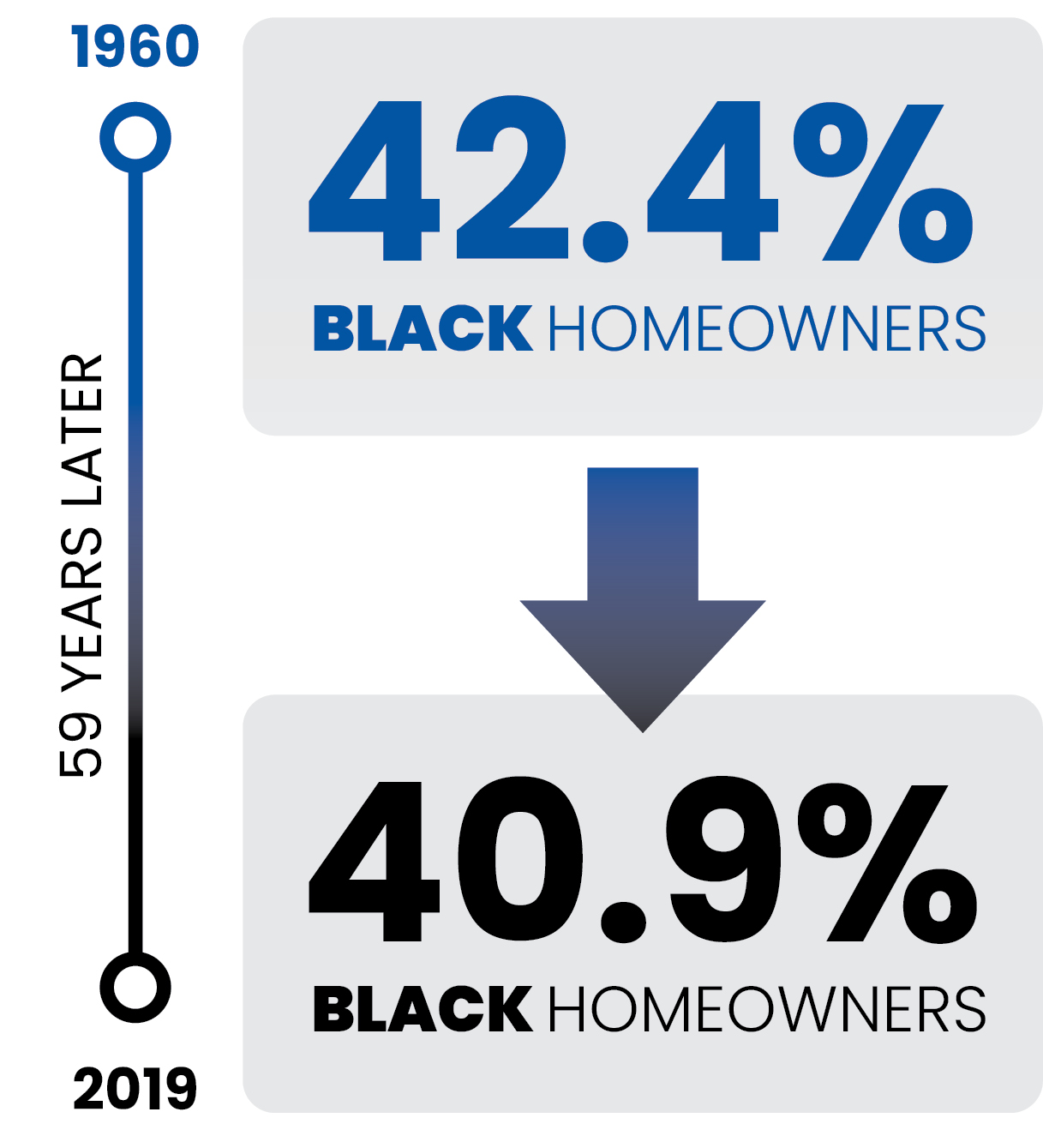

For the entire 2010s, California’s Black homeownership rate has been lower than it was in the 1960s, when it was completely legal to discriminate against Black homebuyers. The 2019 statistics show that just 41% of Black families own their homes compared to 68% of White families.

Note: Data above is from the 2019 homeownership data collected by the U.S. Census.

Did You Know Video Series

“Did You Know” is an educational video series that details America’s history of housing discrimination that has given white families a better opportunity to build wealth through homeownership than Black people.

The Homestead Acts

The Homestead Act was the earliest attempt by the United States government to provide housing opportunities to its citizens.

Redlining

Redlining was a government sanctioned form of housing discrimination where banks, insurance companies, and mortgage lenders refused to issue loans to people in areas deemed “financially risky.”

Predatory Lending Practices

Predatory lending practices are unethical and illegal practices used by lenders that are unfair to the borrower.

Fair Housing Acts

The Fair Housing Acts were attempts to outlaw discrimination in the sale, rental, or financing of housing based on race.

Tips to Black Homeownership

CalHFA’s Tips to Black Homeownership videos can help first-time homebuyers navigate through the homebuying process. Below, homebuyers can find assistance on topics such as credit, finances and documentation needed when speaking with a lender.

Tips to Black Homeownership videos available:

Building Black Wealth: Participating Lenders

Element Mortgage

Fairway Independent Mortgage Corporation

Guild Mortgage

New American Funding

Supreme Lending